Residential mortgage how much can i borrow

Now is the Time to Take Action and Lock your Rate. They look at that persons annual income and multiply it by a set amount however.

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

Let us Help You Find the Right Budget for You.

. This calculator is being provided for educational purposes only. Trusted VA Home Loan Lender of 200000 Military Homebuyers. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Lender Mortgage Rates Have Been At Historic Lows. How much you can borrow depends on your age the interest rate you get on your loan and the value of your home. Ad Were Americas 1 Online Lender.

Ad More Veterans Than Ever are Buying with 0 Down. We have Mortgage Brokers in all major cities including. You have three main options for receiving your money.

Purchasing a Home Is a Big Decision. The results are estimates that are based on. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Ad Purchasing A House Is A Financial And Emotional Commitment. A maximum of 2 applicants can apply for a new HSBC mortgage. As part of an.

Please get in touch over the phone or visit us in. Ad Calculate How Much Home Can You Afford Backed By Top Mortgage Lenders Save. Ad Compare the Best Mortgage Lenders Picked By Our Experts Get a Great Offer Apply Easily.

This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income. Lenders have a calculation they use when assessing how much to lend a potential borrower. How much can I borrow for a Residential Mortgage.

If a mortgage is for 250000 then the mortgage principal is 250000. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. The maximum amount you can borrow may be lower depending on your LTV and following our.

Check Eligibility for No Down Payment. You pay the principal with interest back to. Trusted VA Home Loan Lender of 200000 Military Homebuyers.

Fill in the entry fields. Most lenders cap the amount you can borrow at just under five times your yearly wage. Depending on a few personal circumstances you could get a mortgage.

Start Here to Discover How Much You Can Afford. Ad Wondering What Your Home Budget Is. Calculate what you can afford and more.

We Are Here To Help You. Take Advantage And Lock In A Great Rate. Lock Your Rate Now With Quicken Loans.

Compare - Apply Get Cheap Rates. This mortgage calculator will show how much you can afford. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

The amount you can borrow for your mortgage depends on a number of factors these include. Well also give you an idea of what your monthly payments might be. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Answer a few simple questions and well help you to work out how much you could afford to borrow. Your salary bill payments any additional outgoing payments including examples such as.

Check Eligibility for No Down Payment. The first step in buying a house is determining your budget. Ad More Veterans Than Ever are Buying with 0 Down.

The Search For The Best Mortgage Lender Ends Today. But ultimately its down to the individual lender to decide. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford.

Use our Free Residential Mortgage Calculator below to work out what your monthly costs and repayment charges will. By helping over 320000 clients within Australia Smartline has become one of Australias most respected mortgage broking groups. For you this is x.

Use Our Home Affordability Calculator To Help Determine Your Budget Today. Mortgage principal is the amount of money you borrow from a lender.

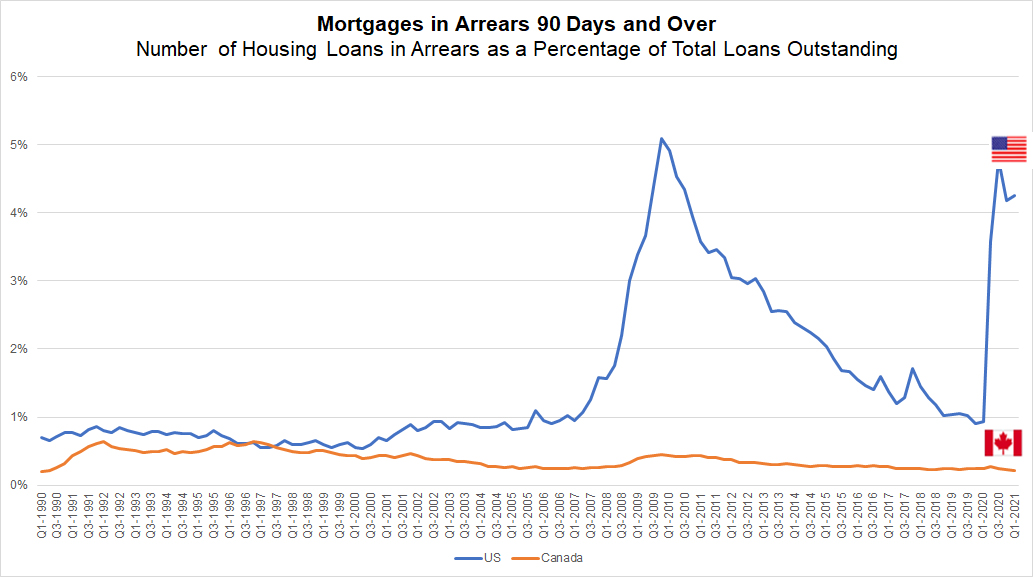

Focus Household Borrowing In Canada Focus Household Borrowing In Canada

Debt To Income Ratios Debt To Income Ratio Debt Income

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

How A Change In Mortgage Rate Impacts Your Homebuying Budget Mortgage Rates Budgeting Home Buying

Wondering How Much Home You Qualify For Interest Rates Have A Big Impact On Your Ability To Borrow Lea Fixed Rate Mortgage The Borrowers Real Estate Services

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payment Calculator

Pin On Mortgage And Loan

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

What Is Loan Origination Types Of Loans Personal Loans Automated System

A Home Loan Or Mortgage Is When You Borrow Money From Another Person Or Institution To Pay For A Property Gettos In 2022 The Borrowers Borrow Money Home Loans

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing